November 4-8th 2024 is Talk Money Week - an initiative from the Money and Pensions Service that seeks to help people have more open conversations about their money - from pocket money to pensions - and continue these conversations all year round.

Money is a deeply emotive topic, and the anxiety, guilt or shame someone might feel around their finances may mean they find it difficult to talk about. Yet research has shown that people who do talk about money make better, less risky financial decisions, feel less anxious and can help their children form good lifetime money habits.

Here’s one Moneyhub feature for each day of Talk Money Week, that can help you to help your customers start talking money:

Budgets, forecasts and spend analysis

-

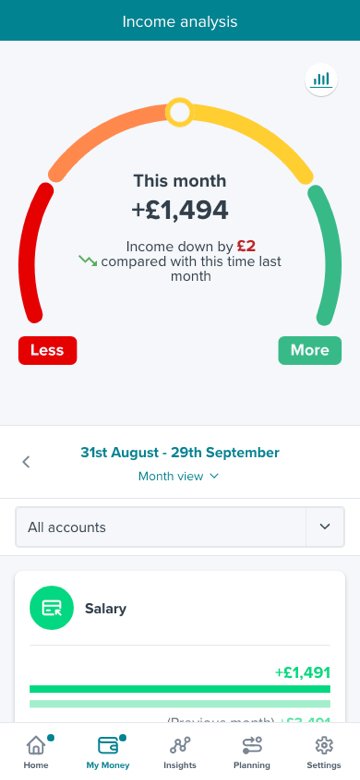

Understanding how much money is coming in, and where it is going out is the first fundamental step towards financial wellness.

One of the most significant sources of financial stress is not knowing if there'll be enough money left at the end of the month. As cash usage continues to decline the increased use of 'Digital' money means its harder than ever to keep track of direct debits, BNPL repayments, ad hoc bills and spending on debit, credit cards or payment services like Paypal.

-

Our budgeting, forecasting and analysis features make getting those healthy foundations in place as easy and intuitive as possible.

Users are encouraged to connect all of their spending accounts to give them a complete picture of their finances. Our technology can then identify income, regular bills and payments and the spending and income analysis helps build a very tangible, visual representation of what’s going where.

Every transaction is categorised so that the customer can create and set spending budgets for things such as fuel for the car, the weekly food shop, clothes for the kids or home repairs. No matter what account or card is used to make a payment the category is identified and allocated to the correct budget so they can see where their money goes and, when they are in danger of going over budget and take avoiding action.

Personal Debt Manager

-

UK adults owe £1.9t in personal debt. Failing to keep on top of debt can impact health, wellbeing and the ability to work.

A study from the Royal College of Psychiatrists found that half of all adults with a debt problem also live with mental ill-health. This ranged from a consistent feeling of anxiety and low mood to a diagnosed mental health condition.

Debt can be a considerable burden, made worse by dealing with it alone.

Worrying about debt can affect sleep. Losing out on a good night’s sleep can not only affect mood and energy levels, it can also affect someone’s ability to work or have good relationships with friends and family.

All of these things in turn can further add to debt problems.

-

Our Personal Debt Manager gives your customers a suite of tools to help them check, manage and adjust their spending so they stay in control of their income and outgoings.

We know that people get better outcomes when when:

They regularly check income, outgoing and bank statements, and;

Adjust spending on non-essentials when money is tight

Your customers can use Personal Debt Manager to connect all of their bank accounts, credit cards and loans in one place so they can check each and every transaction in real time. They’ll benefit from a range of tools, including Personal Balance Alerts, Spending Analysis, Regular Payments and Rent Recognition.

By utilising these tools, your customers can:

Gain sight of where their money is going and where changes need to be made and set realistic budgets

Reduce the risk of missing a repayment as they have a full list of upcoming payments to help them plan in advance

Even build their credit score through Rent Recognition

Eliminating debt is about more than the numbers - debt relief brings reduced stress and anxiety, improvements in cognitive functioning and changes in decision making. When someone clears their debt, it’s a significant life event.

With Moneyhub, you can help them get there.

Emergency Cash Builder

-

Be it building an emergency cash fund for whatever life throws at them, or saving towards that all important first home, our technology can help you become a significant force for financial good in your customers’ lives.

With the Financial Conduct Authority reporting that nearly 13m UK adults have little capacity to withstand a financial shock, helping your customers build an emergency fund to weather a financial storm, or simply for a rainy day, can improve financial outcomes, build trust in your brand and deepen the relationship they have with your firm.

-

Moneyhub’s Emergency Cash Builder makes it easy for your customers to increase their financial resilience in three simple steps:

Personalise: Choose a connected account in which the emergency cash fund will be created and give the fund a name. It could be simply an ‘emergency fund’, or something more personal, such as ‘my holiday fund’ or ‘Mum’s 60th birthday’. Customers can create multiple funds for different goals. After naming their emergency cash fund the customer will be prompted to set a target amount and time period over which they wish to save.

Monitor: Each Emergency Cash Fund will automatically appear in the customer’s personal dashboard. They’ll see how much they’ve saved in total and how close they are to achieving their goal.

Celebrate: Moneyhub’s dashboard view provides a visual measure of success. Overlay a nudge in the app or any other communications channel to help the customer celebrate their achievement and provide them with an onward journey.

Customers can transfer money to their Emergency Cash Builder fund using their bank’s banking app or by creating a standing order. Or if enabled, they can use Moneyhub Open Banking payments technology to make a payment from within a Personal Financial Management app.

When people have some savings to fall back on, their increased financial resilience leads to reduced stress and anxiety, a greater sense of choice and control and even higher self esteem. With Moneyhub, you can help your customers get there.

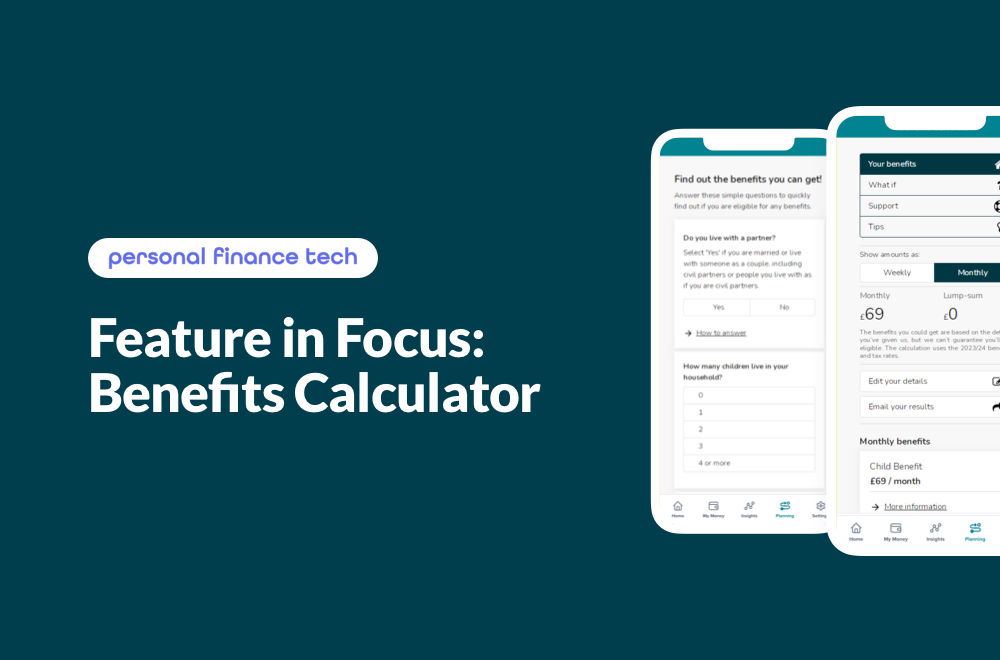

Benefits Finder

-

According to Policy in Practice around 8 Million households in the UK are missing out on £16-19 billion in benefits every year. This works out at around £5k per household, every year - a potential lifeline for low-income households.

In 2021, in the wake of the Covid-19 pandemic, Welfare at a Social Distance found that the most common reason why people miss their benefits is that they are unaware of the welfare benefits they are entitled to or assume that they are not eligible

The main reasons people are not taking up benefits they are aware of:

Group A: 42% Wrongly assume they are not entitled

Group B: 39% Unaware of the range of benefits they could be entitled to

Group C: 19% Don’t apply because they are overwhelmed by the process, or find the stigma difficult to deal with

-

Description text goes hereWe’ve embedded InBest’s Benefits Finder into our Personal Financial Management solution, enabling people to identify benefits they may be eligible for based on their financial data.

The benefits calculator can help those in Groups A and B to find out which benefits they are eligible for and the boost to their income they could receive.

By incorporating the calculator into a financial management app, we can better serve Group C through personalised nudges and support articles, to help guide them through their benefits applications.

Pensions Finder

-

It’s no secret that the pensions industry has an engagement problem. In 2020 the Financial Conduct Authority found 59% of adults contributing to a workplace DC pension have low, or very low pension engagement.

Low levels of engagement correspond with low levels of understanding around pensions, and people are missing out on a better retirement.

In fact, one in five pensioners is now living in relative poverty in the UK, with the number of financially insecure pensioners soaring to more than two million.

With the government’s work on the Pensions Dashboard Programme stalled, our Pension Finder offers an interim tool to help people track down, understand and engage with their pensions.

-

Pension Finder allows people to build a full picture of their pension and make crucial retirement plans by connecting the Moneyhub app with their LinkedIn profile.

It is designed to help pension managers, workplace pension providers, trustees or advisors help their customers engage with their pensions, encourage them to save more cash for retirement and understand the long-term implications of their current financial situation and savings strategies.

Users can combine the pensions information found by analysing their career history with other information aggregated and calculated by Moneyhub in tools such as Moneyhub’s Lifestyle Modeller, which predicts people’s financial situation after a major event such as retirement to set lifestyle expectations.

When people have a complete financial picture they are able to make better decisions or get the help they need. The Pension Finder seeks to make financial admin easier and ultimately encourage savers to take positive steps to secure their future financial wellness.

You can offer your customers any of these features as part of our fully customisable white label financial management app, or incorporate them into your own offering as widgets.