We talk a lot about financial wellness at Moneyhub. But what does it actually mean? Finances are multifaceted and personal to every individual - there’s no clear definition for what ‘good’ or ‘well’ looks like.

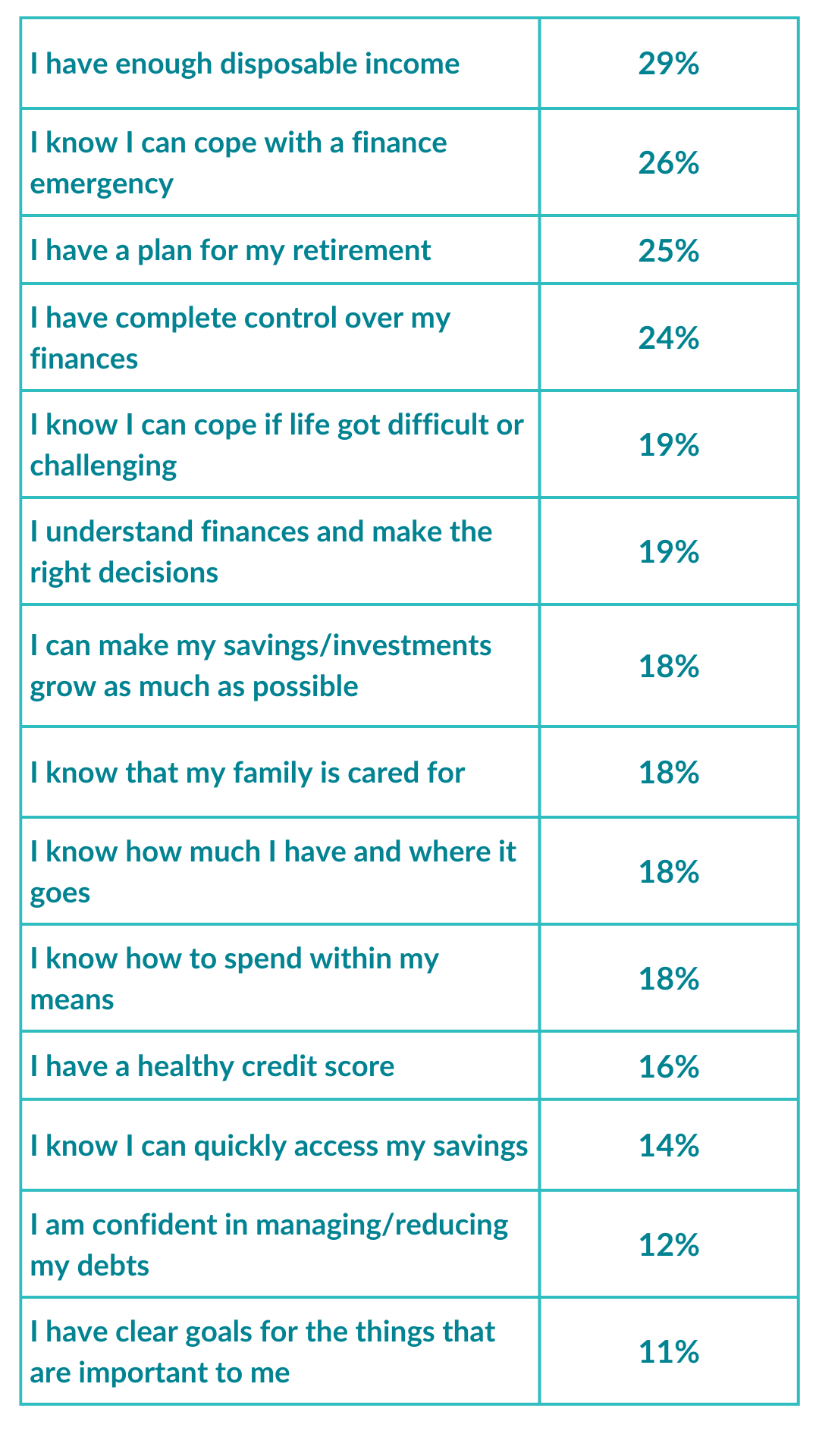

Recognising this, we polled 1,000 UK consumers to find out what financial wellness means to them. Here’s what we found:

Top responses across all respondents

It is clear that financial wellness means different things to different people, with our survey showing some marked differences between different life stages.

What does financial wellness mean to you? A deep dive into generational differences

Age 25-34 - “Understanding finances and making the right decisions” (29%)

Age 35-44 – “I have enough disposable income”, “I can copy with a financial emergency” and “I have a plan for my retirement” (all 23%)

Age 45-54 – “I have a plan for my retirement” and “I have complete control over my finances” (both 26%)

Age 55-64 – “I have enough disposable income” (39%)

Age 65+ – “I have enough disposable income” (39%)

This demonstrates the difference in financial drivers for consumers – drivers that providers must be able to identify, interpret and engage consumers with along their journey. As life stages and requirements evolve, so too should the experiences and services offered. Fail to align, and consumers will happily vote with their wallets, off to a competitor who meets their needs.

If a younger customer is not financially well, and struggling to get through the short-term, it’s highly unlikely they will engage with – or contribute more to – their pension, or add investments into the mix.

Once someone is on top of their day-to-day finances and has built up a rainy day fund to fall back on, their saving and investing potential is increased. In return, this can drive customer primacy for providers – gaining the ownership of a deeper, data-rich relationship so that consumers' needn't turn anywhere else.

The role of Open Finance in enhancing financial wellness

Open Finance platforms, such as Moneyhub, play a crucial role in helping financial services firms serve their customers through all life stages, enhancing their financial wellness journey. Here’s how:

Comprehensive Financial Insights: By aggregating financial data into a single, accessible platform, consumers gain holistic view of their finances. This comprehensive insight allows financial services firms to offer tailored advice and solutions that align with the unique needs of their clients, whether they are focused on saving, investing, or managing daily spending.

Personalised Financial Guidance: The ability of Open Finance platforms to analyse financial data in real-time enables the provision of personalised financial guidance. This means firms can proactively assist clients in achieving their financial goals, such as building an emergency fund, planning for retirement, or managing debt effectively.

Enhanced Customer Engagement: Through intuitive and user-friendly interfaces, Open Finance platforms engage customers more deeply with their financial health, so they needn’t flit between apps. Features such as budgeting tools, spending insights, and goal tracking foster a proactive approach to financial management, encouraging better financial habits and decisions across different life stages.

Data-Driven Decisions: Financial services firms can leverage the rich data provided by platforms like Moneyhub to gain a deeper understanding of their clients' needs and behaviours. This data-driven approach leads to the development of more relevant financial products and services that resonate with customers, thereby fostering stronger, long-term relationships.

As the definition of financial wellness evolves across different demographics, so too must the strategies employed by financial services firms. By harnessing the capabilities of Open Finance platforms like Moneyhub, firms can ensure they provide the personalised, insightful, and engaging services that meet the ever-changing needs of their clients, all within one solution.

If you’d like to find out more about what Open Finance can do for your business, and your customers, just get in touch →