One in ten UK adults have missed a utility bill payment in the last six months according to new research from Moneyhub Payments, highlighting the need for more flexible ways to pay.

Almost half of 18-34-year-olds put off life goals such as children due to affordability

Families are still feeling the acute financial burden caused by increased costs and higher interest rates, and new research from Moneyhub reveals that over half of people regularly worry about their financial situation. The research also shows that UK savers believe their banks could be doing significantly more to help them get to grips with their finances

The middle-aged are the most likely generation to feel the pressure on their purse strings, with 63% of 45-54-year-olds indicating they are worried about their finances.

However, while a total of 31% of those surveyed admitted to putting off life goals – such as having children – due to not being able to afford it, this figure shot up to 48% for 18-34 year-olds.

The generational differences don’t stop there. Across the two-fifths of respondents who regularly finish the month with no money in their accounts or with an overdraft, this number jumped to 54% for those aged 25-33 years old and fell to 35% for 55-60-year-olds.

Following a difficult year for personal finances, which saw consumers grapple with high inflation and soaring costs, 44% of respondents said they had to dip into their savings in the past 12 months. A further 28% said that they are struggling to save, while 18% have an erratic approach to savings, with some months being better than others. Tellingly, only 15% of respondents said they are able to save a significant portion of their income each month.

Although the research nods to the difficulties presented by macroeconomic pressures, it also shows that banks and financial institutions could do more to help. Over a third (34%) of respondents said that banks and financial institutions don’t make it easy to understand finances, and 31% said that they would save more if they understood their finances better.

When asked what they think banks can do to make life easier, 16% said that they’d like nudges for when they could be saving money or switching to better savings rates. 13% would like access to free money management apps that allow them to see and understand all their finances, and 12% said they wanted easier methods to contact customer services.

Kim Jenkins, Managing Director of Moneyhub API, said: “Our research makes it clear that there is an opportunity to help customers understand and manage their finances. By using the available technology, banks and financial institutions would be able to help their customers properly understand their financial situation and provide smart nudges that would help them make better financial decisions.

Through Open Banking capability and easy-to-build solutions such as Moneyhub’s Smart Saver API Recipe, banks can provide a helping hand for their customers to budget and know precisely when they have excess to save. This will also enable them to deliver better customer outcomes.”

About the research:

The research was conducted by Censuswide with 2,000 Nationally representative general consumers between 27.10.23 and 31.10.23. Censuswide abides by and employs members of the Market Research Society, which is based on the ESOMAR principles and is a member of The British Polling Council.

About Moneyhub’s Smart Saver Recipe

Moneyhub’s Smart Saving API recipe supports customers’ financial journeys through personalised and automated saving. With enhanced visibility through Open Banking and Open Finance offers, customers identify their realistic savings goals and expedite the process. The right mix of account aggregation and nudges.

With the data in hand, nudges instigate action. With the data in one view, nudges can trigger the right questions at the right time, helping more customers build their savings and become more financially resilient.

About Moneyhub

Moneyhub is a data, intelligence, and payments company which develops ISO 27001 certified software for Open Banking, Open Finance, and Open Data applications. Its FCA-regulated Open Data platform enables companies to quickly and easily transform data into personalised digital experiences and initiate payments. Its APIs and fully customisable platform provide data aggregation, insights, notification nudges, and payment systems. As a result, clients have the consent-driven data and analytics they need to create super-personalised offers, products, and services. Hundreds of organisations, spanning finance to media and retail, rely on Moneyhub’s award-winning technology.

For more information, please visit www.moneyhub.com.

Moneyhub to provide Open Banking solutions to UK government

London, 12 February 2024: Moneyhub has been named as a supplier on Crown Commercial Service’s (CCS) Open Banking Dynamic Purchasing System (DPS) framework for its Open Banking and Payment services.

Crown Commercial Service supports the public sector to achieve maximum commercial value when procuring common goods and services. In 2021/22, CCS helped the public sector to achieve commercial benefits equal to £2.8 billion - supporting world-class public services that offer best value for taxpayers.

Moneyhub, is the leading data and payments platform built on Open Banking and Open Finance principles. Its solutions already help businesses in various sectors increase efficiency and offer consumers efficient, secure alternatives to card and cash payments.

Through its work with clients such as Nationwide, Lloyds Banking Group, Standard Life, Legal & General, amongst hundreds of others, Moneyhub has proven the benefits of Open Banking and account-to-account payment solutions. Government organisations' ability to purchase Moneyhub services through the DPS will help more public sector services increase efficiency and experience the benefits that Open Banking delivers.

Vaughan Jenkins, Managing Director of Partnerships at Moneyhub, comments: “At Moneyhub we're on a mission to enhance the lifetime financial wellness of people, their communities and their businesses, and the public sector has a significant opportunity to benefit from and lead the way in the mass adoption of Open Banking solutions.The continued adoption of Open Banking technology will result in better outcomes for taxpayers and the country.”

ENDS

Notes to editor:

About Moneyhub:

Moneyhub is a global ISO 27001 certified software developer of Open Banking, Open Finance, and Open Data applications. Its FCA-regulated Open Data platform enables companies to quickly and easily transform data into personalised digital experiences and initiate payments. Its APIs and fully customisable platform provide data aggregation, insights, notification nudges, and payment systems. As a result, clients have the consent-driven data and analytics they need to create super-personalised offers, products, and services. Hundreds of organisations, spanning finance to media and retail, rely on Moneyhub’s award-winning technology

For more details, please visit www.moneyhub.com.

About Crown Commercial Service:

Crown Commercial Service (CCS) is an Executive Agency of the Cabinet Office,

supporting the public sector to achieve maximum commercial value when procuring

common goods and services.

To find out more about CCS, visit: www.crowncommercial.gov.uk

Follow us on Twitter: @gov_procurement

LinkedIn: www.linkedin.com/company/2827044

Moneyhub’s Personal Finance Technology continues its strong performance with new client wins

Moneyhub, the award-winning top 100 global fintech, is continuing its upward trajectory announcing three new cross-industry partners in recent weeks for the Personal Finance Technology (PFT) line of business.

PFT, which drives financial wellness through its personal finance solutions, helps its clients to support their customers by better understanding, managing and growing their money. Additionally using its award-winning platform, PFT provides notable opportunities for better Consumer Duty outcomes. This growing market proposition has seen increasing appeal from the advisory and accounting sectors, showcased by recent wins from WPS Advisory, The Tax Guys and 1Legacy.

WPS Advisory (WPSA)

WPSA are committed to making high quality support, guidance and financial advice both accessible and affordable via their LifeStage proposition, with open banking at its very heart.

The partnership will see an app built on Moneyhub’s Open Banking technology, through which an individual will be able to clearly visualise and manage their current financial position, with an immediate pivot into a representation of their financial future, creating an environment where the user can see the impact of their decisions today on their life tomorrow.

The project supports evolution in the employee benefit and wellbeing space, as Moneyhub work with WPSA to engineer better financial outcomes for consumers and seek to solve one of the biggest mental health burdens on UK employees: Financial Stress.

Simon Chrystal, CEO at WPS Advisory comments:

“WPS Advisory have created a unique employee benefit in LifeStage which is designed to provide employers with a full employee support and financial confidence framework which helps align people and commercial objectives.

Our aim, working with Moneyhub as a partner, is to be able to provide full employee support, by combining our own people skills with leading edge technology.

Lifestage provides access to tailored and affordable financial advice at key life stages by means of subscription and employer sponsorship. The App and its wide ranging functionality is supported within an Open Banking framework.”

The Tax Guys

The Tax Guys are a tax advisory and accountancy services leader targeting sole-traders and small businesses. Seeking a digital solution to help clients stay on top of their finances and reduce the administrative burden of filing clients’ tax returns, they approached Moneyhub.

The Tax Guys will be offering their clients free access to a co-branded version of Moneyhub’s award-winning consumer app through Moneyhub’s Multibuy Plan proposition. This demonstrates their commitment to the financial wellness of their customers, as well as enabling those customers to easily share accurate data with The Tax Guys via the app for their tax returns digitally throughout the year.

Jonathan Amponsah, Managing Partner at The Tax Guys comments: “We’re delighted to partner with Moneyhub to roll-out a real win-win solution for The Tax Guys and our clients: we can streamline the admin involved in submitting tax returns, make it easy for our clients to share relevant data with us, and help them improve their financial wellness.”

1Legacy

1Legacy is a market innovator with a soon-to-launch digital portal that will help people navigate different stages of their financial life, plan for retirement, preserve assets and remove some of the heavy lifting involved in leaving and receiving a financial legacy through inheritance.

1Legacy are white labelling Moneyhub’s financial management platform to offer their customers a complete and accurate picture of their finances alongside liquidity, assets vs. liabilities ratio and a probate cost calculator. Moneyhub is integrating with secure document storage vault Legado and scanning service Cleardata to enable 1Legacy users to access all of their important relevant documents, such as their will, through the app.

Hendrik Bruinette founder at 1Legacy said: “We want to give people at every stage of life the intuitive tools they need to feel empowered and navigate life’s transitions. Whether that’s becoming a parent, preparing for retirement or getting an idea of what you are able to leave your loved ones. Navigating a financial legacy has traditionally involved stacks of paperwork and many complicated moving parts. Moneyhub’s technology will help us remove some of the administrative burdens and give people a really clear picture of what they’ve got, and what that looks like as a legacy. They have been fantastic at integrating with other systems to fit our requirements and we are excited to continue our work together.”

Mark Horwood-James, MD of Moneyhub’s Personal Financial Technology said: “ It’s heartening to see more businesses and sectors putting financial wellness at the heart of their strategy. Now, more than ever, people want and need to take control of their money, and seek out firms they entrust to help them do that through tools and technologies. We are very excited to be working with WPS Advisory, The Tax Guys and 1Legacy to unlock their customers' financial potential as well as help these clients achieve their strategic goals.

The adoption of Open Finance technology benefits consumers and businesses alike, driving financial wellness for individuals, and offering firms unparalleled insights to drive better customer outcomes in line with Consumer Duty.”

-Ends-

Notes to editors

Contacts

Ingrid Anusic

Marketing Director, Moneyhub

ingrid.anusic@moneyhub.com

M: +44 783 722 6553

Eleanor Ross

Senior Account Director, Teamspirit (Moneyhub PR Agency)

ERoss@teamspirit.uk.com

M: +44 7393 758 446

About Moneyhub

Moneyhub is a data, intelligence, and payments company which develops ISO 27001 certified software for Open Banking, Open Finance, and Open Data applications. Its FCA-regulated Open Data platform enables companies to quickly and easily transform data into personalised digital experiences and initiate payments. Its APIs and fully customisable platform provide data aggregation, insights, notification nudges, and payment systems. As a result, clients have the consent-driven data and analytics they need to create super-personalised offers, products, and services. Hundreds of organisations, spanning finance to media and retail, rely on Moneyhub’s award-winning technology.

For more information, please visit www.moneyhub.com.

Moneyhub first to add Co-op Bank, Smile Bank and Kroo Bank Open Banking Connections

Moneyhub offers the widest breadth of any provider with thousands of connections covering financial services globally

Moneyhub, the market-leading data and payments platform, has today announced it has become the first third-party provider (TPP) to connect to Co-op Bank, Smile Bank and Kroo Bank.

The Co-op Bank is the UK’s first ethical bank providing a range of banking products and services to c.2.7m retail customers, as well as providing business loans, credit cards and deposit products to a growing pool of UK businesses. Smile Bank, a trading division of the Co-op Bank, was the UK’s first, and original digital bank offering full-service current accounts, savings, ISAs, investments and credit cards.

Kroo Bank, a digital bank launched in December 2022 aiming to change banking for the better, offers customers a current account, an overdraft, deposit protection up to £85,000 and zero fees on spending abroad.

Moneyhub is a global provider of Open Banking account connectivity. In the UK alone it provides connections to thousands of institutions.

Moneyhub’s technology offers a simple solution to connect across current accounts, savings, loans, investments, mortgages, property valuations, automotive and pensions, providing a holistic view of an individual’s finances. It enables actionable insights through its smart nudges and machine learning.

Over 150m people have access to Moneyhub’s technology through their partners such as Aon, Standard Life, and SEI Investments, or directly through its personal finance app which can be accessed through the App Store, or Google Play.

Dan Scholey, CCO at Moneyhub comments: “Our users have been increasingly asking for connections to Co-op, Smile and Kroo, so we’re delighted to announce that we have become the first TPP in the UK to connect with them via Open Banking.

“We want to ensure that we continue to offer our users the most comprehensive set of connections in the UK to ensure they can see a true, holistic view of their finances on the app or through one of our partners’ platforms. Only with a holistic view can we truly make informed decisions on our finances, receive personalised advice and guidance, and ensure we are all prepared for later life.”

-Ends-

Notes to editors

Contacts

Ingrid Anusic Eleanor Ross

Marketing Director, Moneyhub Senior Account Director, Teamspirit (Moneyhub PR Agency)

ingrid.anusic@moneyhub.com ERoss@teamspirit.uk.com

M: +44 783 722 6553 M: +44 7393 758 446

Research Methodology

Research conducted by Censuswide among 1004 pension savers. The research fieldwork took place between 2nd August and 7th August 2023. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct which is based on the ESOMAR principles.

About Moneyhub

Moneyhub is a data, intelligence, and payments company which develops ISO 27001 certified software for Open Banking, Open Finance, and Open Data applications. Its FCA-regulated Open Data platform enables companies to quickly and easily transform data into personalised digital experiences and initiate payments. Its APIs and fully customisable platform provide data aggregation, insights, notification nudges, and payment systems. As a result, clients have the consent-driven data and analytics they need to create super-personalised offers, products, and services. Hundreds of organisations, spanning finance to media and retail, rely on Moneyhub’s award-winning technology.

For more information, please visit www.moneyhub.com.

VOXI provides customers free access to Moneyhub’s financial management app

VOXI by Vodafone expands its partnership with Moneyhub to offer customers free access to its financial management, engagement and wellness app for 12 months

Moneyhub’s consumer app can help VOXI customers take control of their finances through AI-powered technology

Moneyhub already provides an automated FCA-regulated eligibility checking service for its VOXI For Now tariff - VOXI's social tariff which gives unlimited 5G data, calls and texts for just £10 a month to those receiving specified benefits, meaning it's quicker and easier for those eligible to access the tariff*

VOXI by Vodafone has expanded its partnership with Moneyhub, the award winning top global fintech, to offer customers 12 months of free access to its financial wellness app.

From today, VOXI customers will be able to claim free access to the Moneyhub app (usually £14.99 annually), as part of the latest series of benefits and rewards available through its VOXI Drop customer reward programme. To redeem the offer, customers simply need to log into their VOXI online account and click on the VOXI Drop section. There are 30,000 codes to be claimed on a first come first served basis.

Moneyhub’s technology allows users to connect their different accounts (current, savings, mortgages, pensions, credit cards, investments, properties and more) to one dashboard and view their entire financial world in one place. From there, they can utilise an ever-growing suite of tools to help them understand their money and reach their financial goals, including; Spending Budgets, Spending Analysis, Savings Goals, Rent Recognition, as well as an array of educational content.

Scott Currie, Head of VOXI, said:

"With over half of Gen Z expressing concern about their financial situation, we are delighted to offer our customers free access to Moneyhub's award-winning financial management app, enabling a simple and effective way to better understand and manage their finances”**

“This initiative, coupled with our market leading proposition VOXI for Now, underscores our ongoing commitment to supporting young people navigate a challenging economic environment.”

Mark Horwood-James, MD of Personal Financial Technology at Moneyhub, comments: “We are delighted to be partnering with VOXI by Vodafone to help get this technology into their customers’ hands. Through the Cost of Living crisis and beyond, consumers need simple and accessible ways to manage their finances which focus on supporting financial wellness.

“VOXI offering access to the Moneyhub app via VOXI Drop will make a significant difference to their customers, as it can genuinely help people better understand their finances and embed healthier money habits now, and for the long term.”

VOXI is the mobile network for young people, offering contract-free plans that let you use selected social and video apps, endlessly, without eating into your general data allowance. VOXI Drop launched in January 2019 and more than three quarters of a million rewards have been redeemed to date. The loyalty programme gives customers exclusive freebies every month from well-known brands.

-Ends-

Notes to editors

* Terms and conditions apply. Please visit https://www.voxi.co.uk/for-now for more information

**About the research: The research was commissioned by Moneyhub and conducted by Censuswide with 2,000 Nationally representative general consumers between 27.10.23 - 31.10.23. Censuswide abide by and employ members of the Market Research Society which is based on the ESOMAR principles and are members of The British Polling Council.

T&Cs

Please note that VOXI does not give any financial advice and is in no way liable or responsible for any of the financial informationadvice provided via Moneyhub.

Moneyhub Giveaway: Offer open from 09:00 16th January and codes must be redeemed by 23:59 on 31st December 2024. Offer is a yearly subscription to Moneyhub. There are 30,000 codes to giveaway. Subscription does not auto-renew after 12 months. To redeem the offer, you must claim a code within the VOXI Drop section of My Account. Follow the link to redeem your code and enter the code on Moneyhub’s website when signing up. One code per VOXI customer. You can't enter if don’t live in the UK or under the age of 18. Offer can’t be exchanged, refunded, transferred or used in conjunction with any other offer. Terms & Exclusions apply.

About VOXI

VOXI by Vodafone, the mobile network for young people, offers plans that let you use selected social and video apps in UK as much as you like, without eating into your general data allowance. Customers also have unlimited calls and texts. VOXI SIM-only plans work on a flexible monthly subscription with no contract; you’re free to change, pause or cancel your plan whenever you like.

About Moneyhub

From day-to-day money management, to building wealth and achieving financial wellness or making more accurate lending and collection decisions, Moneyhub’s award-winning technology has gained investment from Nationwide Building Society, Phoenix Group, Legal & General and Lloyds Banking Group. The business boasts more than 100 enterprise clients such as Admiral, Standard Life, Aon, Mercer, SEI and Vodafone.

Moneyhub's goal is simple; to work with its clients to improve the financial wellness of people, their businesses, and their communities. Hundreds of companies use its Open Banking and Open Finance technology to better understand their customers through data so they can comply with Consumer Duty, deliver them more suitable products, and automate money management or payments to ultimately increase their capacity to spend, save or invest more.

For more information, please visit www.moneyhub.com.

Almost three in ten (29%) UK consumers who missed a payment or went into their overdraft have done so despite having funds in another account

Moneyhub says understanding the customer context is essential following the latest FCA Consumer Duty Review.

On December 14/Yesterday, the FCA published the Multifirm Review of its investigation of Retail Banks, which it carried out ahead of the Consumer Duty coming into force last July.

Commenting on the findings, Suzanne Homewood, Managing Director of Decisioning at Moneyhub said:

“The FCA review shows that some retail banks not only struggle to provide evidence of good consumer outcomes but also to define what constitutes a good outcome. It shows that firms don’t have the broader insights to understand the context of a customer. Data deficiencies and inadequate information architectures are severely hampering a more holistic view of the customer, which is where we are helping retail and SME banks, of all sizes, to overcome”.

In a desk-based review of 70 product journeys across a range of 47 firms, the FCA highlighted a range of concerns. For example, mortgage lenders were not always aware that customers were using their products for debt consolidation and Business Current Account providers lacked insights on vulnerable customers. The FCA reiterated that:

“Firms need to ensure they have the appropriate MI and can evidence the outcomes their customers are receiving”.

Suzanne Homewood of Moneyhub continued:

“The review took a product and customer journey approach but the real insights are gained when a customer data lens is applied. Our technology is enabling firms to identify customer behaviours and to use these to create unique segmentation models. Our Detect, Intervene and Report solutions can be applied to the banks’ own data alone or expanded to include 3rd party data, with customer consent, through our award-winning Open Data platform”.

“The FCA Review represents a mock examination in one sector but it shows the scope to do better. Now that the Duty is in force and with closed book business coming into scope next year, firms will face the stiffer test of FCA supervisory visits”.

“The FCA expects firms to put consumers at the heart of what they do and that can only be done with customer centric data and analytical tools being in place. Moneyhub’s solutions are exactly that and are being used by CMA9 banks, challengers and more broadly product providers. It’s already giving them competitive and compliance advantages”.

About Moneyhub

Moneyhub is a data, intelligence, and payments company which develops ISO 27001 certified software for Open Banking, Open Finance, and Open Data applications. Its FCA-regulated Open Data platform enables companies to quickly and easily transform data into personalised digital experiences and initiate payments. Its APIs and fully customisable platform provide data aggregation, insights, notification nudges, and payment systems. As a result, clients have the consent-driven data and analytics they need to create super-personalised offers, products, and services. Hundreds of organisations, spanning finance to media and retail, rely on Moneyhub’s award-winning technology.

For more information, please visit www.moneyhub.com.

Pension illiteracy impact: 1 in 6 Brits say they don’t know how much is going into their pension

11% of savers say they couldn’t accurately describe what a pension is (1 in 9)

11% said they don’t know how much they contribute to their pension (1 in 9)

17% are unsure how much their employer contributes (1 in 6)

31% of women are not confident that they will have enough income for a comfortable retirement (1 in 3)

A simple lack of understanding of pensions – what they are and how they work - could be preventing workers from saving for their retirement, according to research from Moneyhub, the award-winning data and payments platform built on Open Banking and Open Finance principles.

The research revealed that one in ten (11%) respondents said they couldn’t accurately describe what a pension is, while a further quarter (24%) said they don’t understand the tax benefits of a pension.

Demonstrating the extent of the lack of engagement with pensions, savers were also largely unaware of how much they were putting into their pension, with 11% saying they don’t know how much they contribute, and a further 17% unsure how much their employer contributes.

Without an accurate understanding of pensions and what they are saving, consumers are at risk of not saving enough for retirement. Indeed 22% said they didn’t understand how much income they would likely receive in retirement based on their current pension savings and 28% were concerned they would not have enough to afford a comfortable retirement. This rises to 39% for 45 to 53 year olds.

In line with the well documented gender pension gap, women in particular were more likely to have a limited understanding of pensions, and how much they contribute. And concerningly, this lack of understanding has translated into 31% of women saying they are unsure they’ll have enough income for a comfortable retirement compared to 24% of men.

Savers are in danger of not being able to make the necessary decisions to ensure they are prepared for their later life if they don’t get to grips with how much they have in their pension and are contributing now. Through Open Finance, not only is this possible, but with the benefits of AI driven smart nudges and modellers, savers will be supported in making the best financial decisions for their circumstances.

With Moneyhub’s Open Finance powered technology, it is already possible for savers to view some of their pensions next to their savings, investments, mortgages and properties all in one place. Having one central, accessible place for savers to find, view and track every one of their pensions - including State, Workplace and Personal - will further encourage active engagement with pension savings. This is crucial to ensure consumers have a holistic view of their finances and can make confident, informed financial decisions.

Mark Horwood- James, MD of Moneyhub Personal Finance Technology comments: “A simple lack of information is set to impede millions of workers from enjoying a comfortable and secure retirement. It’s a real concern that such a high percentage of people continue to be unsure about their income when they retire. Also troubling to us is that these doubts are reflected in a disparity between men and women.

“Thankfully, with Open Finance technology available today, this information gap can be quickly filled. It falls on the government as well as employers to remove any impediments to engagement by ushering in the widespread use of new technologies such as Moneyhub.

“Having easy access to all their pensions in one place, and being able to view them alongside their other financial products such as savings or mortgages as well as their properties, will enable savers to make better decisions when it comes to preparing and planning for the life they would like in retirement.”

Notes to editors

Contacts

Ingrid Anusic Eleanor Ross

Marketing Director, Moneyhub Senior Account Director, Teamspirit (Moneyhub PR Agency)

ingrid.anusic@moneyhub.com ERoss@teamspirit.uk.com

M: +44 783 722 6553 M: +44 7393 758 446

Research Methodology

Research conducted by Censuswide among 1004 pension savers. The research fieldwork took place between 2nd August and 7th August 2023. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct which is based on the ESOMAR principles.

About Moneyhub

Moneyhub is a data, intelligence, and payments company which develops ISO 27001 certified software for Open Banking, Open Finance, and Open Data applications. Its FCA-regulated Open Data platform enables companies to quickly and easily transform data into personalised digital experiences and initiate payments. Its APIs and fully customisable platform provide data aggregation, insights, notification nudges, and payment systems. As a result, clients have the consent-driven data and analytics they need to create super-personalised offers, products, and services. Hundreds of organisations, spanning finance to media and retail, rely on Moneyhub’s award-winning technology.

For more information, please visit www.moneyhub.com.

Cogo and Moneyhub join forces to help financial institutions develop ethical, sustainable and financial wellness products

Cogo, the sustainability fintech that partners with financial institutions to help customers lower their carbon footprint, and Moneyhub, the award-winning data and payments platform built on Open Banking and Open Finance principles, are joining forces to help banks and financial institutions develop more ethical and sustainable financial wellness products to help support their customers in taking better decisions for their finances, lifestyle and the climate.

Moneyhub granted Credit Information Services permissions by the Financial Conduct Authority

Scottish Widows partners with Moneyhub to help customers see all their finances in one place

Moneyhub appoints Nick Middleton as Strategic Account Director for Partnerships

To consolidate or not to consolidate: One in ten pension savers don’t think it’s worth the effort to combine pensions

Moneyhub top 100 ‘most promising’ fintech startups in the world for 2023

One in five now make payments using Open Banking

Auto-enrolment - savers with workplace pensions are more than twice as likely to be disengaged

Savers with workplace pension schemes are significantly less likely to understand or engage with their pensions compared to their counterparts with personal pensions, according to new research from Moneyhub, the award-winning data and payments platform built on Open Banking and Open Finance principles.

Heads in the sand: Quarter of pension savers never check their pension

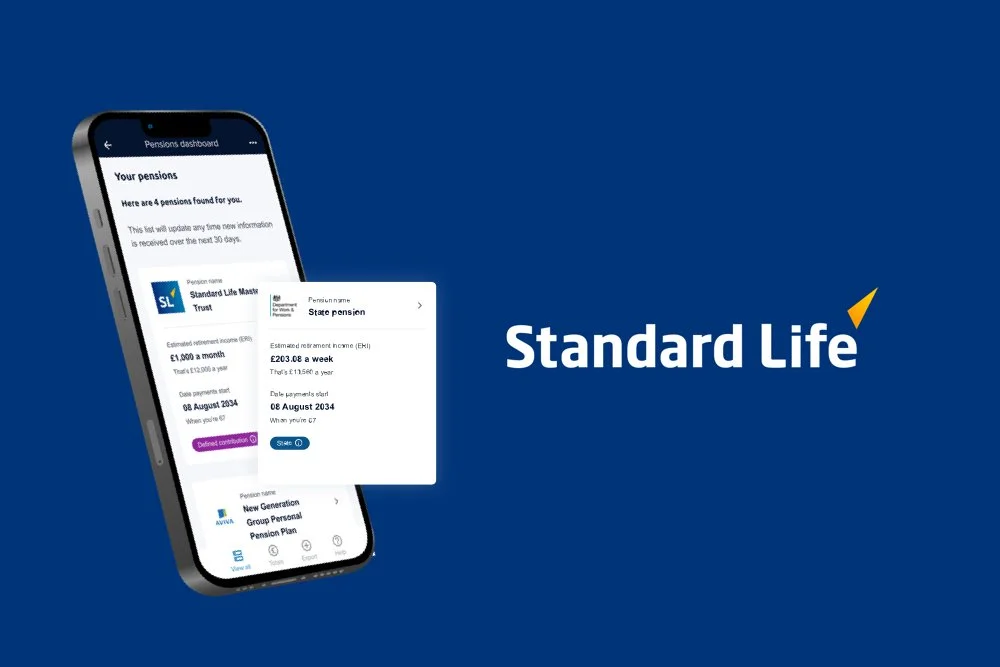

Standard Life strengthens partnership with Moneyhub and announces plans to deliver commercial pensions dashboard

Standard Life, part of Phoenix Group, the UK’s largest long-term savings and retirement business, has partnered with Moneyhub, the market-leading Open Banking and Open Finance platform, to deliver its pensions dashboard. This marks the first UK provider to commit to offering a commercial pensions dashboard.